Are Equities Setting Up for a Huge Fourth-Quarter Rally?

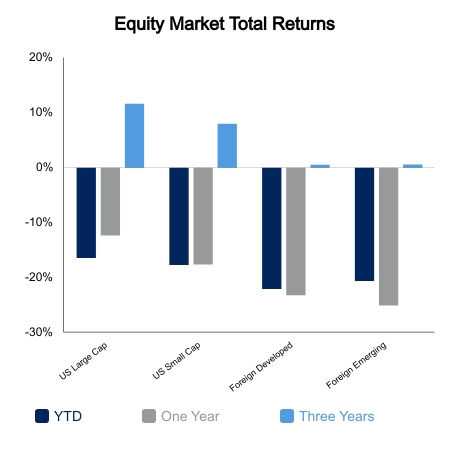

A sharp rally to end the week resulted in a mixed equity picture. The S&P 500 finished up 0.7%, while the NASDAQ and Russell 2000 finished slightly in the red. Despite the muted returns, there was plenty of noteworthy action under the surface. The NASDAQ recorded seven-consecutive losing sessions before a sharp rally on Wednesday. It was the longest losing streak since 2016.

Watching Volatility

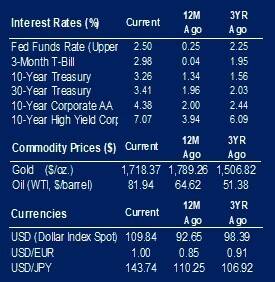

The dollar traded to a new 20-year high this week.

- The Japanese Yen continues its freefall versus the U.S. dollar, thereby pressuring Chinese competitiveness in the region.

- Speculation is surfacing that China will devalue to support a struggling economy.

- Interest rate differentials and monetary policy divergence have pushed the JP Morgan Currency Volatility Index up over 70% in the last year. This rate of change is highly correlated to global recessions.

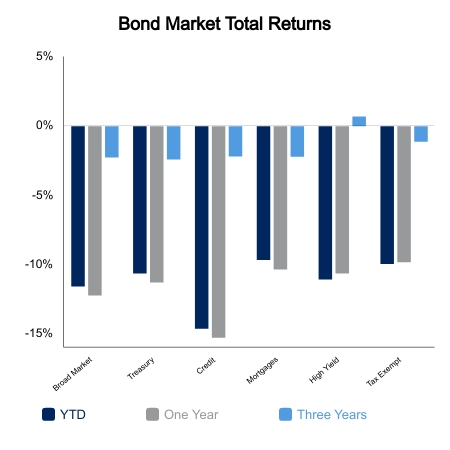

Fixed income yields have gone straight up since Jackson Hole when Fed Chair Powell communicated a hawkish policy path in 2023. Every hiking cycle has ended with the Fed Funds rate rising above the Consumer Price Index (CPI). The idea this cycle was initially scoffed at with CPI at 9.1% and the Fed Funds rate at 2.5%. It would be too much pain they said, but more people are coming around to the idea. The current gap is about 6%. Much debate now centers on how this will come to fruition. The Fed appears to be communicating a path of getting the Fed Funds rate toward 4% and holding as long as it takes to bring CPI down below this level. The alternative is aggressively hiking to stamp out persistent inflation, but this appears less likely. Fed communication about wanting only a couple months of lower CPI readings suggests they will likely reduce the pace of rate hikes as they approach 3.5%, which the market is pricing in to occur in November.

Against this backdrop, equity volatility remains extremely muted given cross-asset pricing actions and the current drawdown in the S&P 500. September remains the weakest month seasonally for domestic equities, and often prices reach a near-term low near the end-of-month option expiration. As is the case in the Twitter age, this is overwhelmingly known by most participants. The recent drawdown could just be front running this event, thereby muting the historical tendency and causing re-grossing of equity later this month.

Catalysts for a Fourth-Quarter Rally

- China has significant room to ease policy, but most think they need to end their zero-Covid policy first.

- Inflation readings are likely to come down, possibly sharply due to commodities.

- The market could then anticipate a Fed pivot.

- Short positioning is elevated and can add fuel to a rally.

- Anything less bad on the Russia-European front will be a tailwind to risk assets.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.