Soft Landing

In last year’s Economic Themes 2023, we prognosticated an economy that would prospectively walk a fine line and be characterized by marginally positive growth while the rate of inflation continued to gradually work its way lower. An economy on the precipice of recession due to the resolve of the Federal Reserve (Fed) to squelch an inflation rate that remained well above its targeted level. The economy generated GDP growth of 5.2% in the third quarter and is forecast to register an increase of 2.4% for all of 2023. With perfect hindsight, we can state that rather than walking a fine line the U.S. economy exhibited an impressive level of strength in 2023.

A key component of the better than expected showing for the economy in 2023 was the continued strength of the labor market. Highlighting this resilience is an unemployment rate that has yet to breach the 4.0% threshold, despite the significant increases in the Fed Funds Rate implemented by monetary policy officials. While the labor market has been resilient, it has shown signs of moderation as the JOLTS Survey of Job Openings most recently registered a reading of 8.7 million. This level represents a meaningful decline from the peak of 12.0 million in March 2022 but is still meaningfully higher than the pre-pandemic peak of 7.6 million in October 2018. Also, monthly increases in non-farm payrolls continue to register levels greater than 100,000 which suggests demand is easily keeping up with increases in the labor force supply.

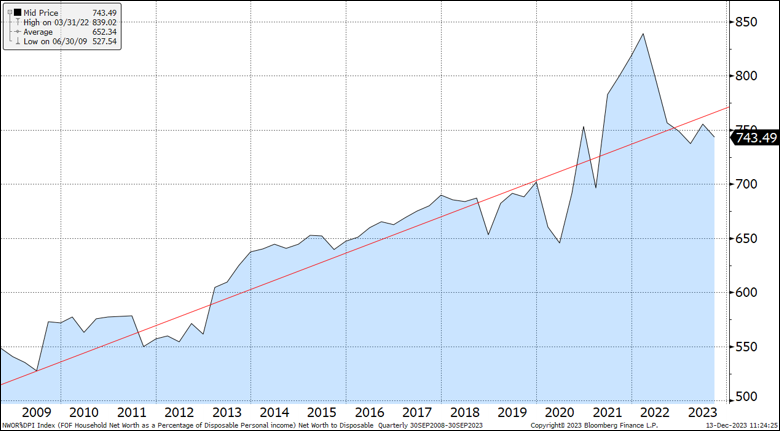

With stability in the labor market and solid returns from financial assets this year (particularly U.S. equities) the U.S. consumer is not only employed but has become wealthier. The graph below depicts the relationship between household net worth and disposable income and reveals that the latest reading indicates household wealth is over seven times higher than disposable income. This indicates that the U.S. consumer has a wealth buffer which supports future consumption. While data shows that lower income households have seen their savings buffer decline, middle/upper income households have seen their wages keep better track with inflation and even generate real wage gains. This means that for those households, savings remains a contributor to wealth and is therefore available to sustain consumption, even if an economic slowdown were to occur.

Net Worth-to-Disposable Income 7.4X

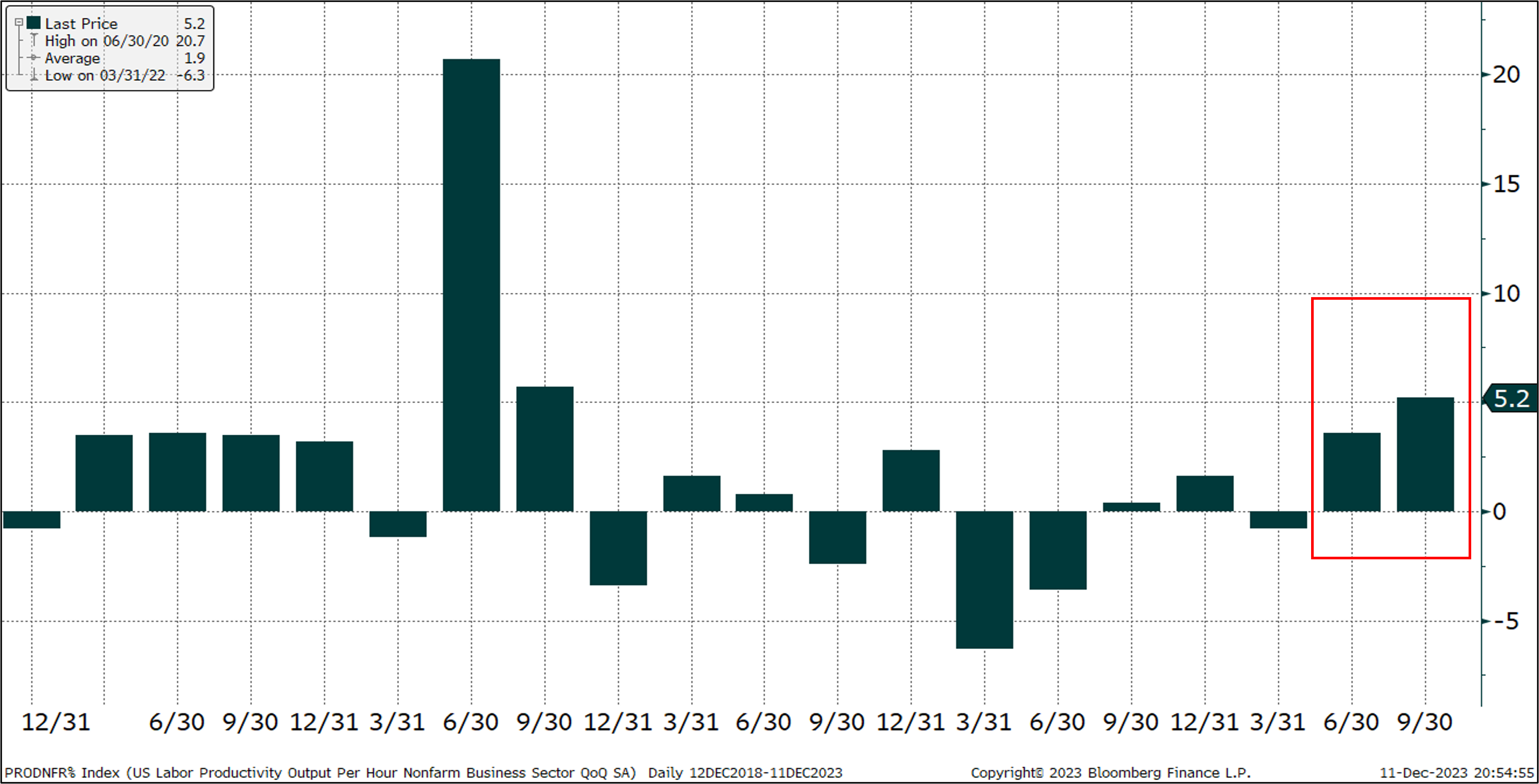

Another key variable that has shown more recent improvement is productivity. What makes productivity such an important consideration economically? It facilitates the ability of an economy to grow without creating inflationary pressure as productive inputs are used at a higher level of efficiency. As depicted in the graph below, U.S. productivity over the last two reporting periods has seen the strongest increases for a two-quarter period since 2020. This trend of stronger readings may continue as ongoing investment in technological tools could lead to even greater efficiencies.

Productivity—Key to Soft Landing Scenario

Based on the information provided above it could be interpreted that we are in the camp of a “soft landing” for the U.S. economy next year. And indeed, our base case for the U.S. economy in 2024 is for continued, albeit modest, GDP growth. But rather than being viewed as being supportive of the “soft landing” scenario it is more of an assessment of a normalizing economy after the tremendous fiscal and monetary policy steps taken after COVID-19. One of the characteristics of this process would be a Federal Reserve that does not lower rates as quickly as many forecasts anticipate. It becomes evident that the higher rate structure currently in place is sufficient to slow the economy but not push it into recession.

Given this outlook we feel there are two primary risks to this normalization scenario. The first is that after some deceleration in the first half of 2024 the economy will grow more rapidly than expected in the second half. This would potentially lead to the prospect of the Federal Reserve reigniting its efforts to rein in a reaccelerating rate of inflation thereby causing interest rates to increase and the economy to prospectively lose it positive momentum. A large enough increase in rates could finally lead to the recession that was so widely anticipated in 2023.

The second risk to our normalization scenario is that the factors anticipated to lead to a recession this year finally do exert sufficient pressure to push the economy into negative growth territory. These factors include a yield curve that continues to be inverted, the lagged impact of the significant interest rate increases implemented by the Fed, and money supply contraction over the past 12 months, the largest since the Great Depression.

As we were reminded in 2023, the key is to observe various economic data as released and remain vigilant in observing trends as they evolve over time. As former U.S. President Dwight Eisenhower stated, “In preparing for battle I have always found that plans are useless, but planning is indispensable.” We too, will adjust our planning process as needed throughout the year.

Sources: BTC Capital Management, Federal Reserve, Bloomberg, Bureau of Labor Statistics

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.