Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- International Index Performance

- Three Year Look at Commodity Prices

- Real Yields Surge

- USA Real GDP

- Rotary Rig Count

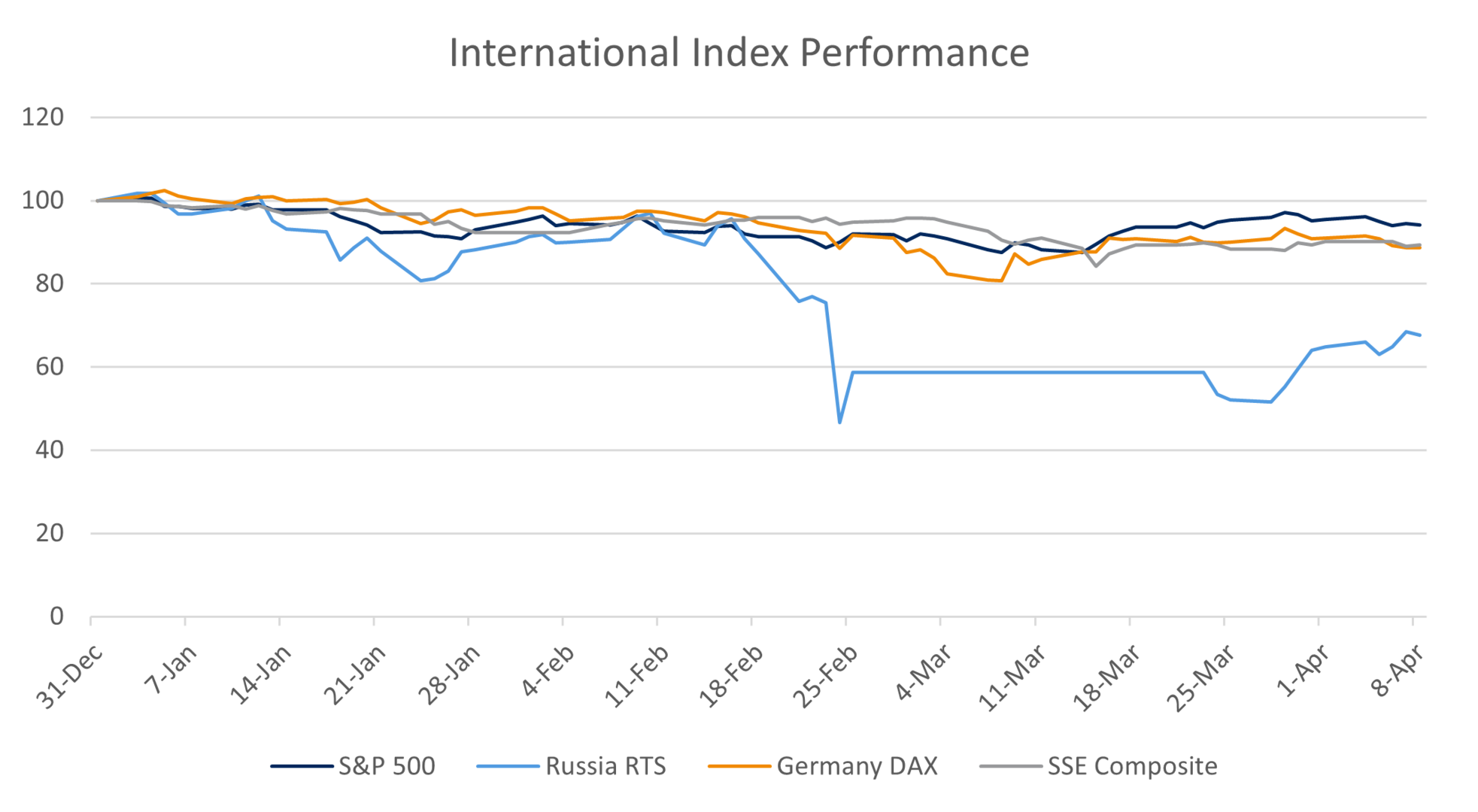

1. International Index Performance

- As of April 8, the S&P 500 Index is down 6.4%, the Russia RTS Index registers -33.5% year-to-date, the German DAX Index has declined 10.8%, and Shanghai’s SSE Index is down 10.5%.

- Performance did show improvement in March as broad global indices rose.

- The Russia-Ukraine conflict has weighed heavily on European stocks.

- Shanghai stocks have been negatively impacted by recent COVID lockdowns.

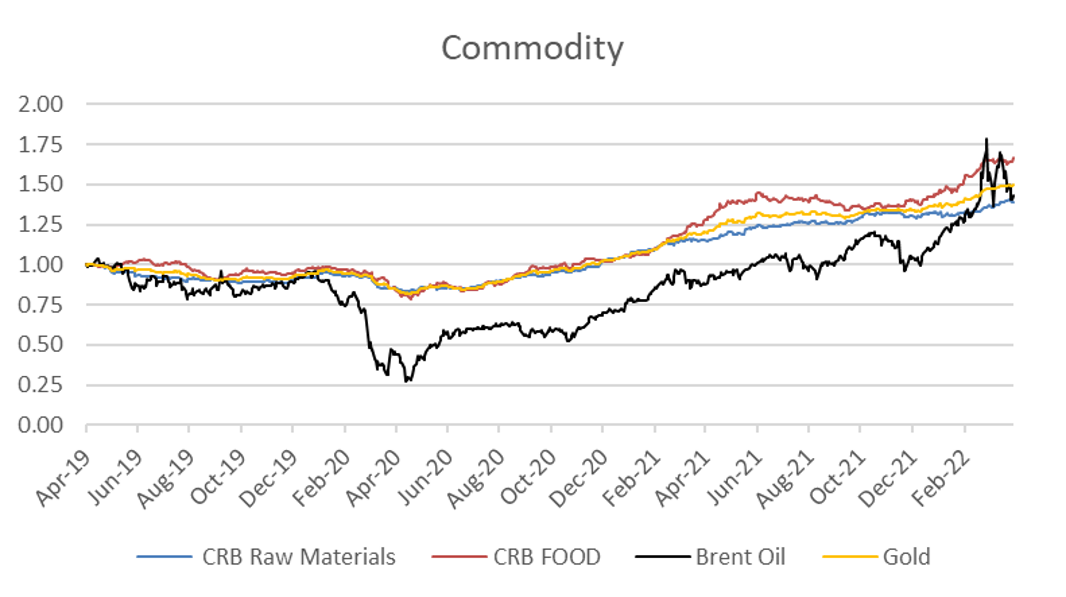

2. Three Year Look at Commodity Prices

- Commodity prices have risen steadily since the pandemic lows in mid-2020.

- While all commodities have moved higher since year-end 2021, oil and food showed the highest rates of acceleration.

- Supply as well as demand is impacting commodity pricing.

- Gold, a traditional inflation hedge, has shown only a modest price increase in the current elevated inflation environment.

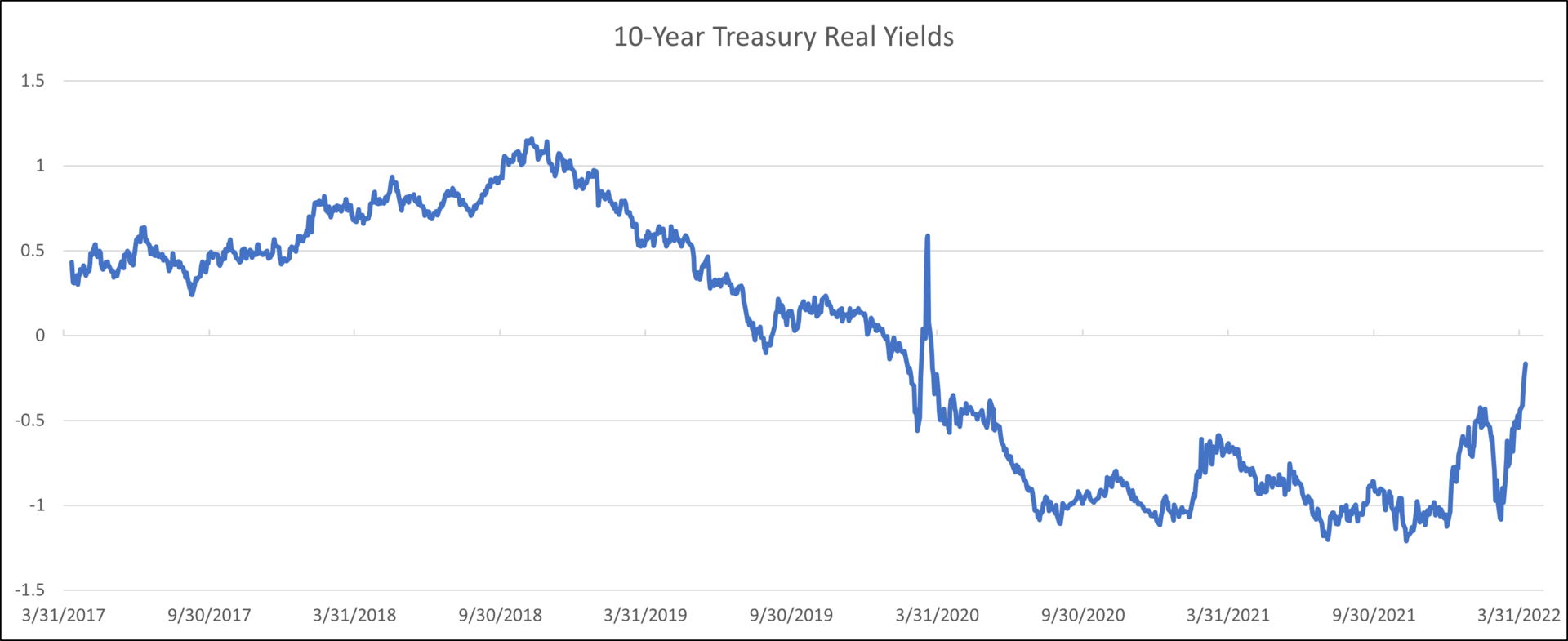

3. Real Yields Surge

- 10-year real yields are up more than 80 basis points in 20 days.

- In the past 15 years, the only larger moves were in 2008 and 2013.

- This will slow the real economy with a lag.

- The 2008 and 2013 spikes marked the peak as the Fed remained or increased accommodation.

- This time, the Fed has been outspoken about continuing to tighten financial conditions.

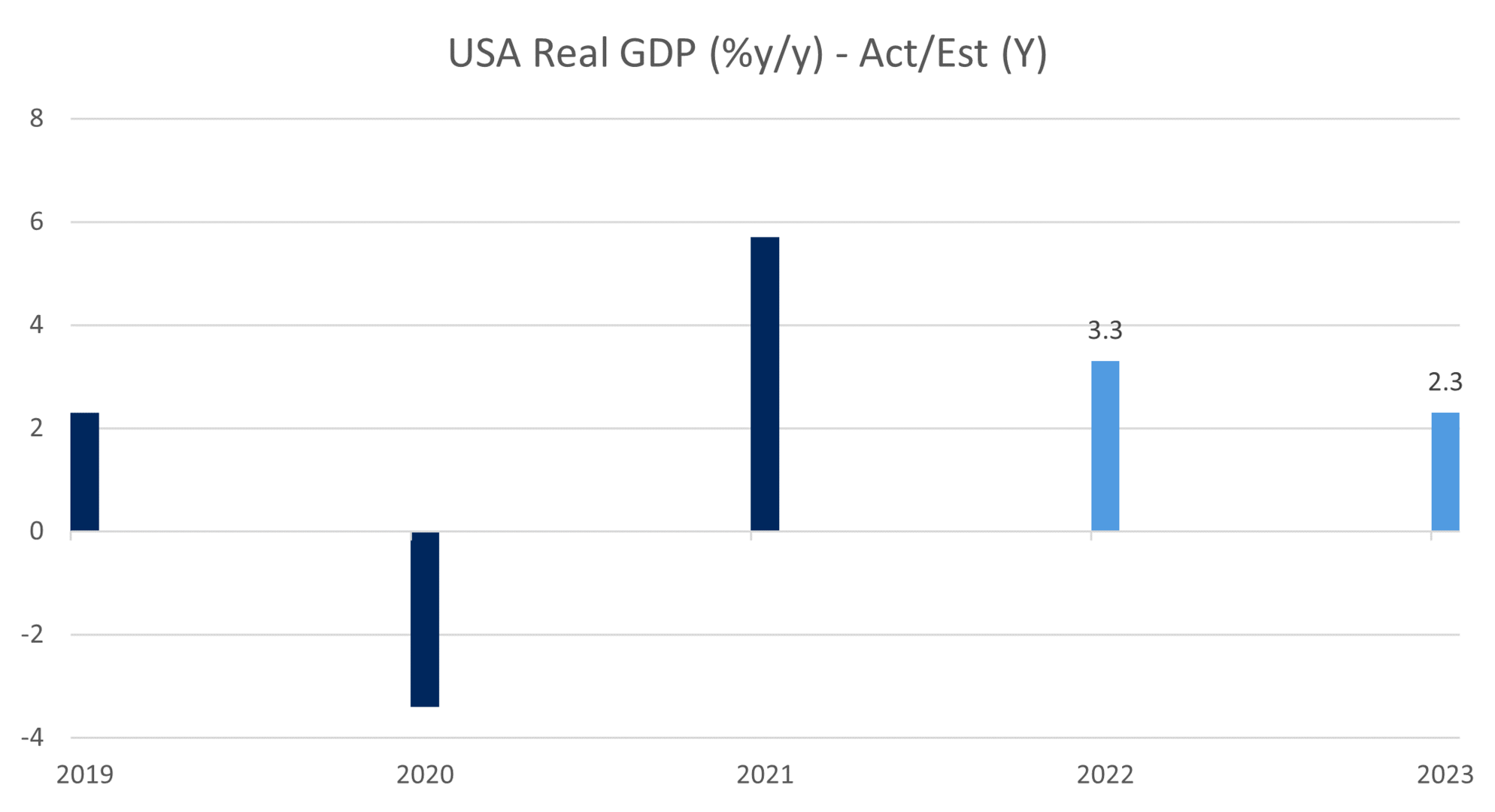

4. USA Real GDP

- Despite the uncertainty created by Russia’s invasion of Ukraine, high inflation and COVID lockdowns in China, economic growth is anticipated in 2022 and 2023.

- As illustrated the growth is anticipated to decelerate relative to the strong recovery experienced in 2021.

- Globally, the International Monetary Fund is expected to reduce its 2022 outlook for global economic growth in its updated forecast to be released later this month.

- Changes in monetary policy will play a significant role in the trajectory of future growth.

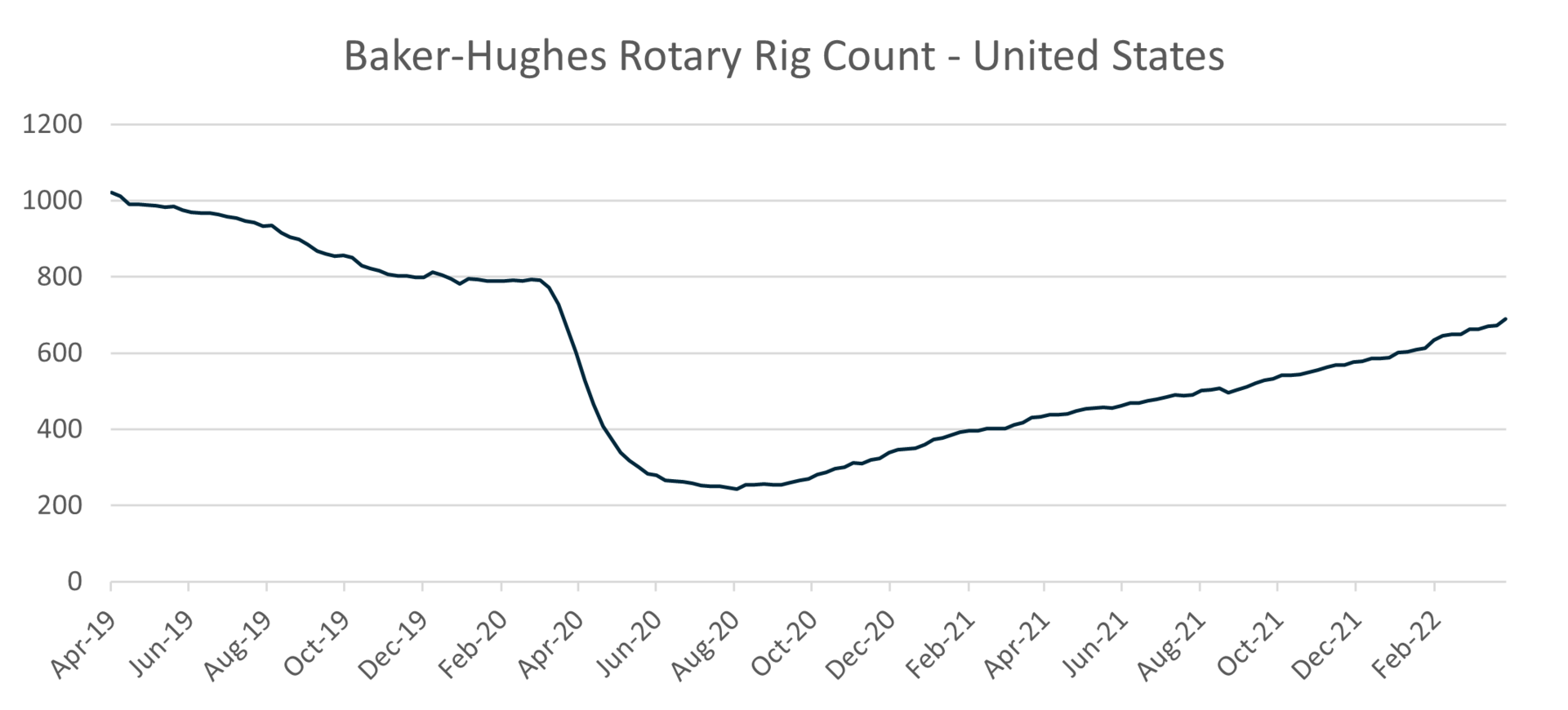

5. Rotary Rig Count

- Despite steady growth, the U.S. oil industry rig count has not recovered as fast as the broad economy post-2020 recession.

- There has not yet been a strong increase in industry capital expenditures (CapEx) reflecting the increase in oil price.

- Companies are hesitant to increase CapEx spending rapidly in case there is a drop in oil prices.

- Despite company concerns regarding future price strength demand for the oil is expected to increase in the next few years.

Source: BTC Capital Management, Bloomberg L.P., FactSet, The Conference Board

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.