Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- 5-Year Treasury Yield

- Highest Semi-Annual Returns for MSCI US Indices

- Comparison of Retail Sales vs. Inflation Excluding Fuel

- Money Supply Falls as Yield Curve Inverts

- Real GDP Outlook

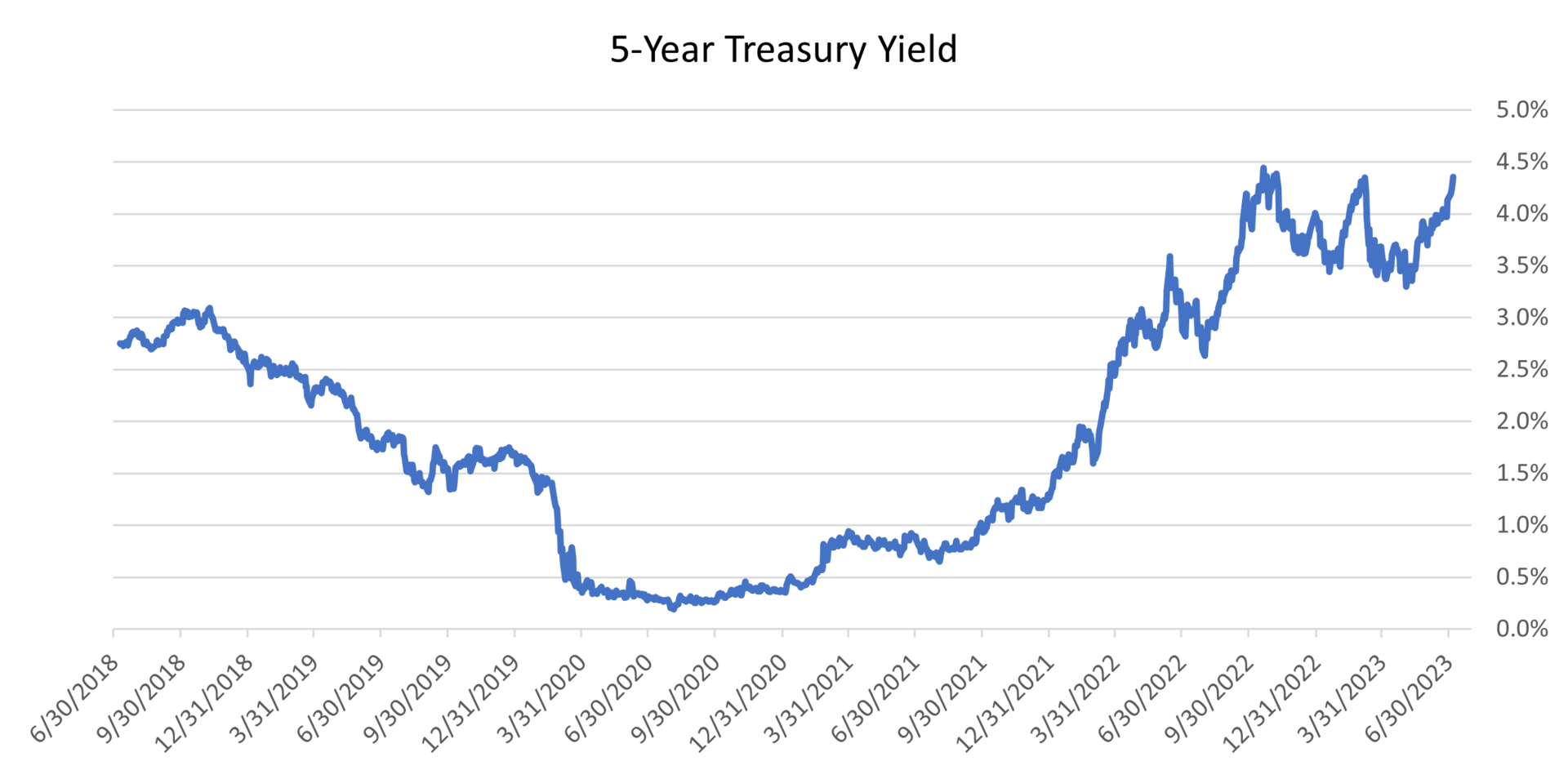

1. 5-Year Treasury Yield

- Treasury yields moving back to cycle highs.

- Employment numbers remain robust along with elevated deficits.

- Real five-year yields are 2.15% and above 2022 highs.

- The market has twice failed to diverge from Fed rhetoric.

- In May, the market was pricing two cuts to the Fed Funds Rate by November.; now it is pricing in 1.5 hikes.

2. Highest Semi-Annual Returns for MSCI US Indices

- The MSCI USA Growth Index return from the first six months of 2023 (up 33.7%) was the sixth highest semi-annual return since the index’s inception going back to 1997.

- While the MSCI USA Growth Index saw record high returns, neither the Value Index nor the broader USA Index saw record high returns, highlighting the fact that strong returns were limited to a narrow band of stocks.

- Interestingly, during the first six months of 2022, the MSCI USA Growth Index was down 30%, demonstrating the volatility of that particular index.

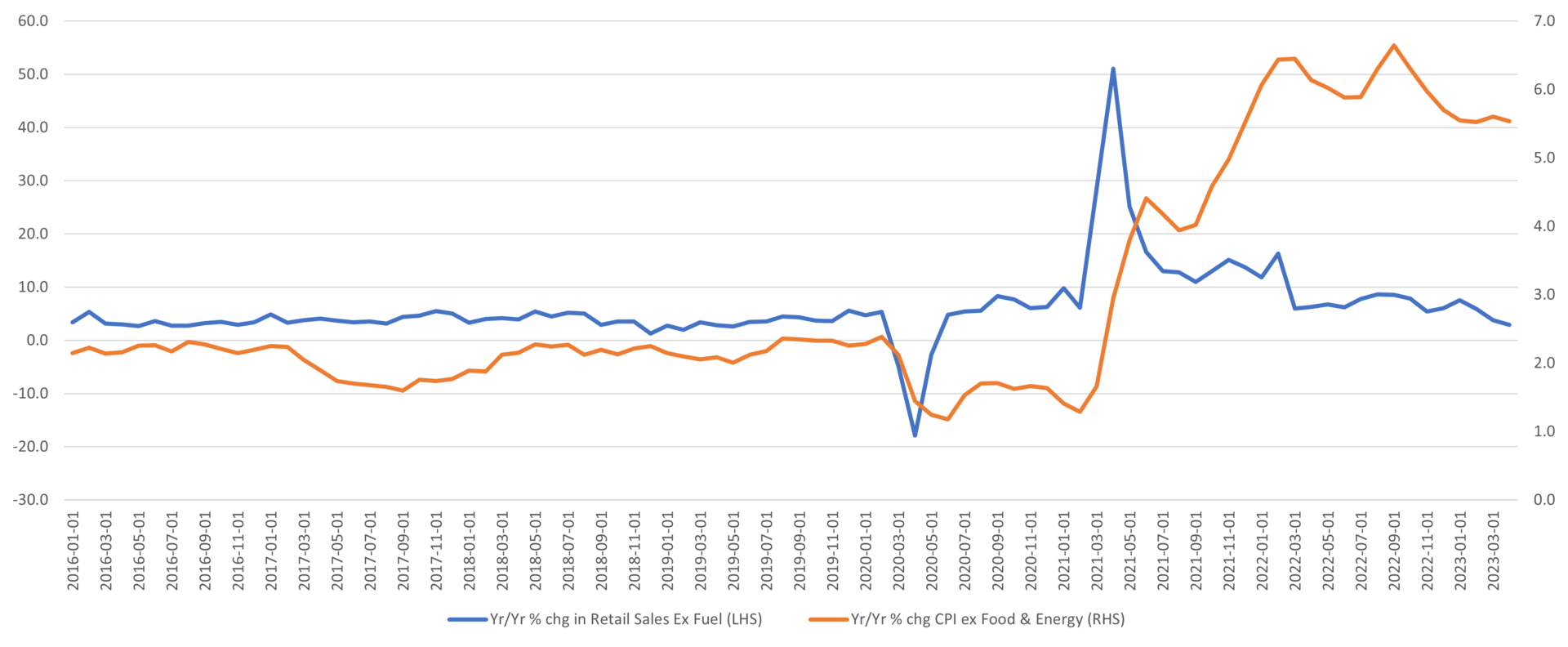

3. Comparison of Retail Sales vs. Inflation Excluding Fuel

- During the period of 2016-2020, core inflation (orange line, right axis) was fairly muted, resulting in low but consistent year-over-year (YOY) growth in retail sales excluding fuel (blue line, left axis).

- Post-Covid, during the recovery, after an initial spike in the spring of 2021, YOY retail sales growth has steadily decreased as core inflation has remained sticky.

- The consumer has been an important part of the recovery. However, with relatively higher interest rates, sticky inflation, and a failed student debt forgiveness bill, questions remain regarding how much spending power the U.S. consumer has left.

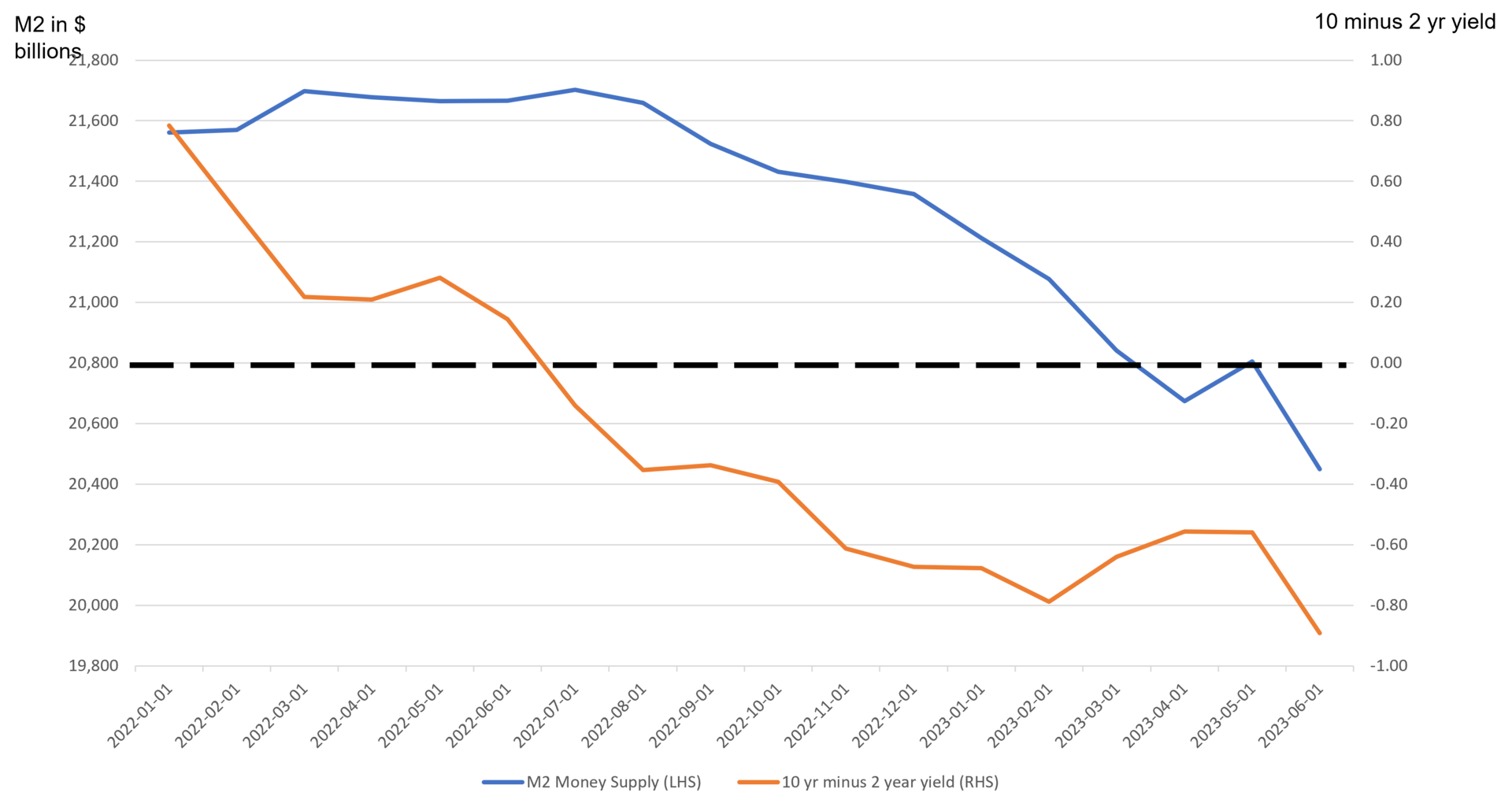

4. Money Supply Falls as Yield Curve Inverts

- Yield spreads between the 10- and 2-year Treasuries began to tighten in 2022, and eventually went negative during the summer of 2022, long thought to be a leading indicator of a recession.

- During this time, the Federal Reserve was raising their key lending rate, which generally deters the borrowing of money.

- Subsequently, the U.S. M2 Money Supply (Cash + Bank account balances + other short-term savings instruments) began to decrease during this time as well. This is a key result of the Federal Reserve raising rates, in order to reduce the amount of “too much money chasing too few goods.”

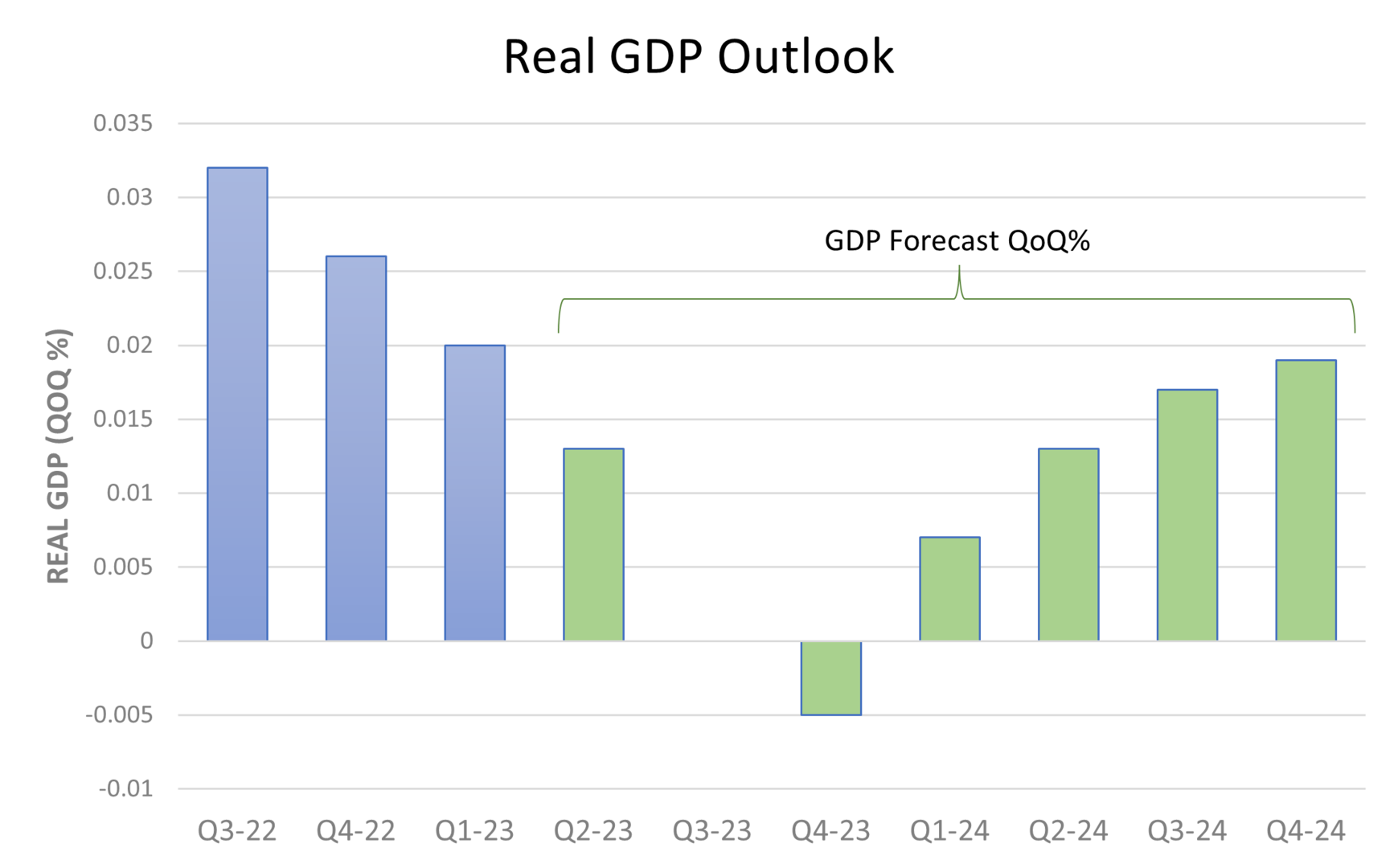

5. Real GDP Outlook

- First quarter GDP exceeds expectations with final estimate of 2.0%.

- A key driver was the 4.2% increase in consumer spending, up from the prior estimate of 3.8%.

- Spending on durable goods rose 16.3% and services increased by 3.2%.

- Exports also made a significant contribution increasing 7.8%.

- Government spending was revised lower for the quarter but still up 5.0%.

- Second quarter GDP forecast to see only a 1.0% increase and the third quarter growth is anticipated to be essentially flat.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.