Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Corporate Bond Yields Look Attractive

- Earnings Growth Forecast to Increase in 2024

- More Downward Earnings Revisions vs. Upward Revisions

- Credit Card Delinquencies on the Rise

- Grocery Inflation Rate Decreasing

1. Corporate Bond Yields Look Attractive

- Corporate bond yields are over 6% in aggregate.

- This is 2.7 standard deviations above the 10-year average.

- Higher coupons offer more protection to rising yields.

- Investment grade corporate bonds are expected to receive inflows from long liability managers such as pensions.

- Corporate bond returns have outpaced Treasuries by an average of 1.28% per year over the last 20 years.

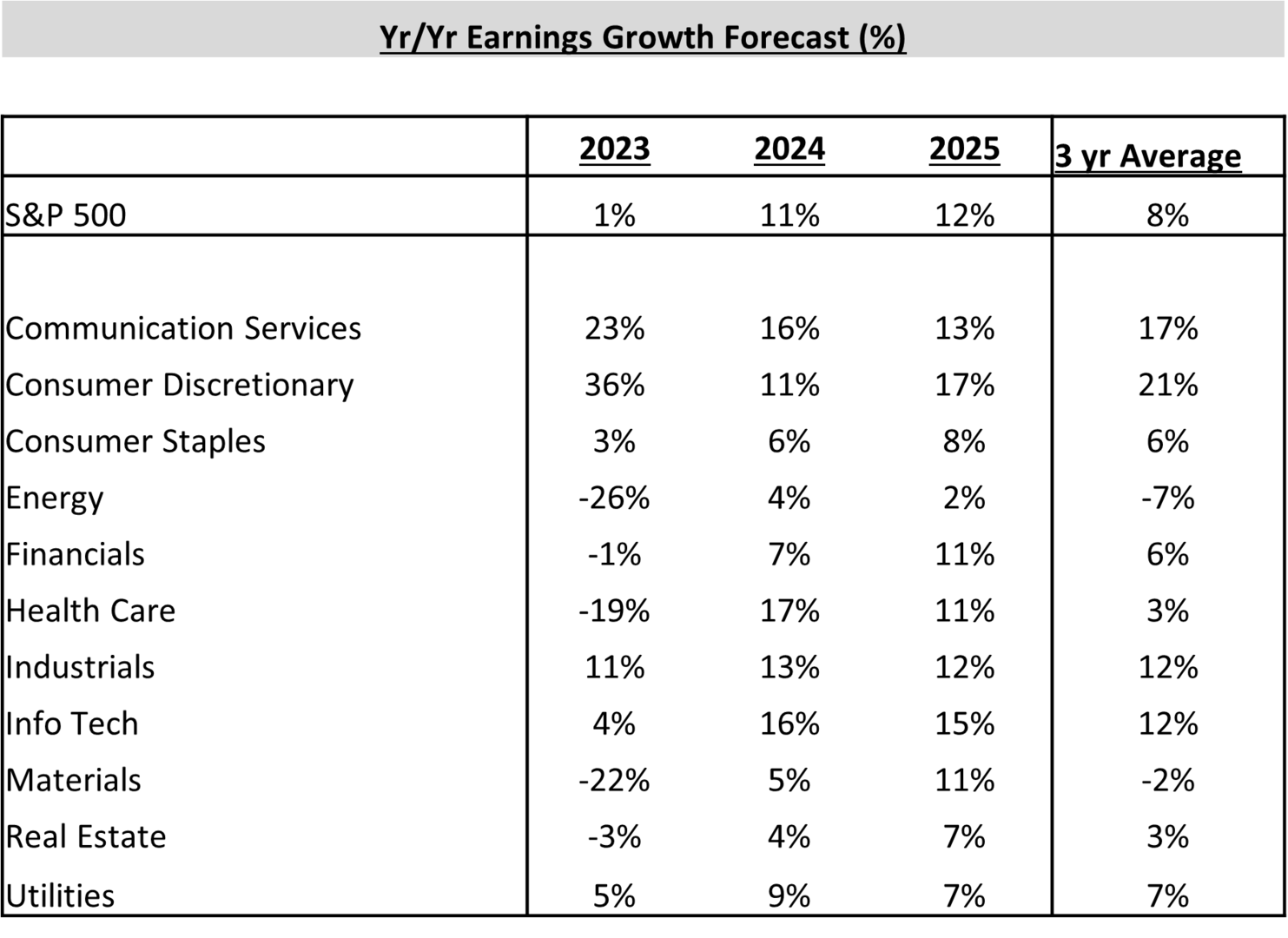

2. Earnings Growth Forecast to Increase in 2024

- Earnings for the overall market in 2023 are expected to have minimal growth compared to 2022.

- However, earnings growth in 2024 and 2025 is expected to rise to low double digits.

- For 2023, there is wide dispersion between sectors regarding earnings growth. Companies in the Consumer Discretionary sector lead the way with 36% forecasted year-over-year earnings growth. Meanwhile, companies in the Materials sector are forecasted to have a 22% decrease in year-over-year earnings.

- The Consumer Discretionary sector is expected to have the highest average earnings growth over the next three years as the strength of the U.S. consumer is expected to remain strong.

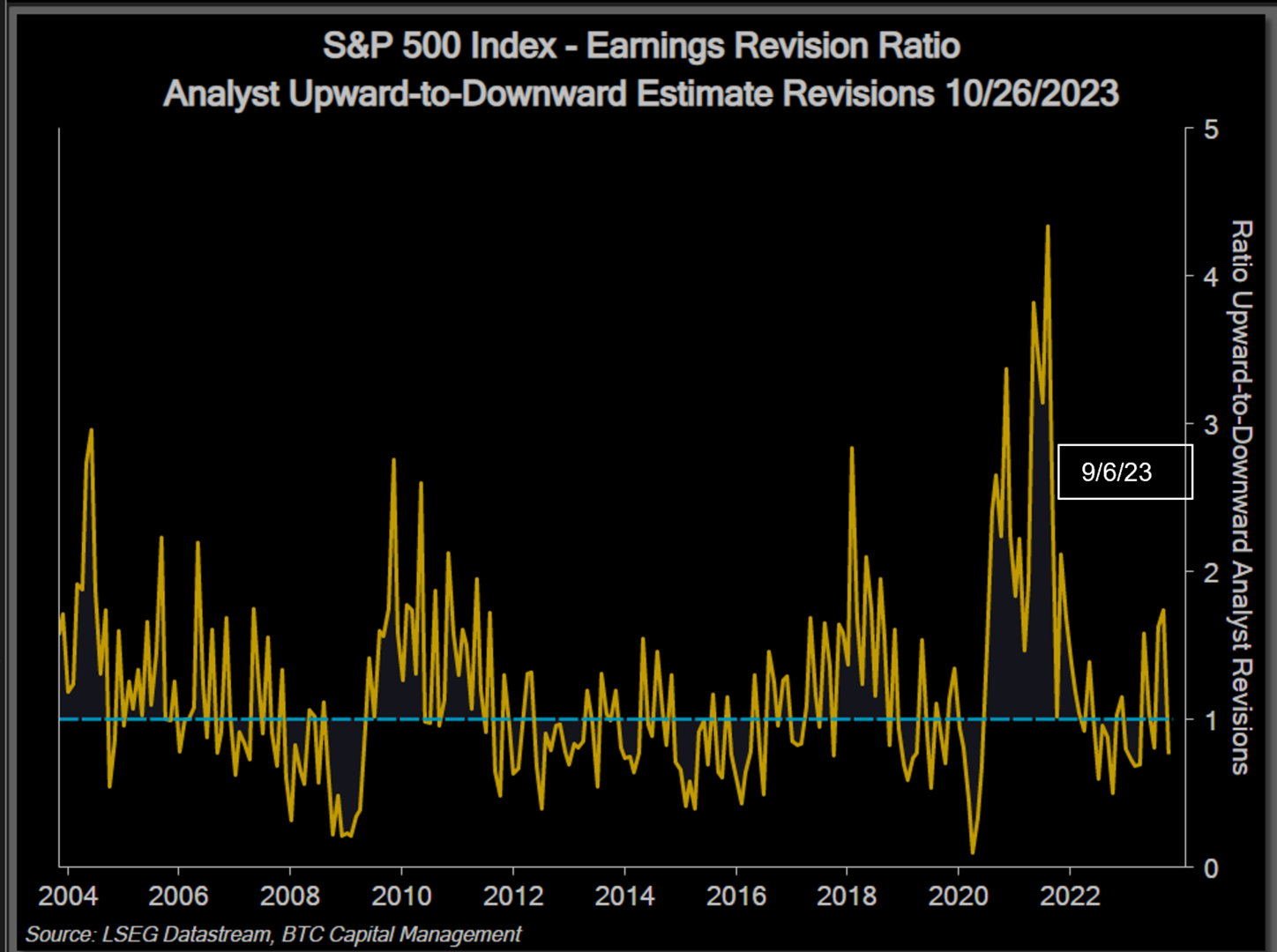

3. More Downward Earnings Revisions vs. Upward Revisions

- Since 2021, the number of upward revisions to analysts’ earnings forecasts had been larger than the number of downward revisions to earnings forecast.

- However, since early September 2023, the number of upward revisions have been falling relative to downward revisions, and in fact, downward revisions currently outnumber upward revisions.

- Many companies have recently revised their own earnings forecasts downward, citing economic headwinds and market uncertainty.

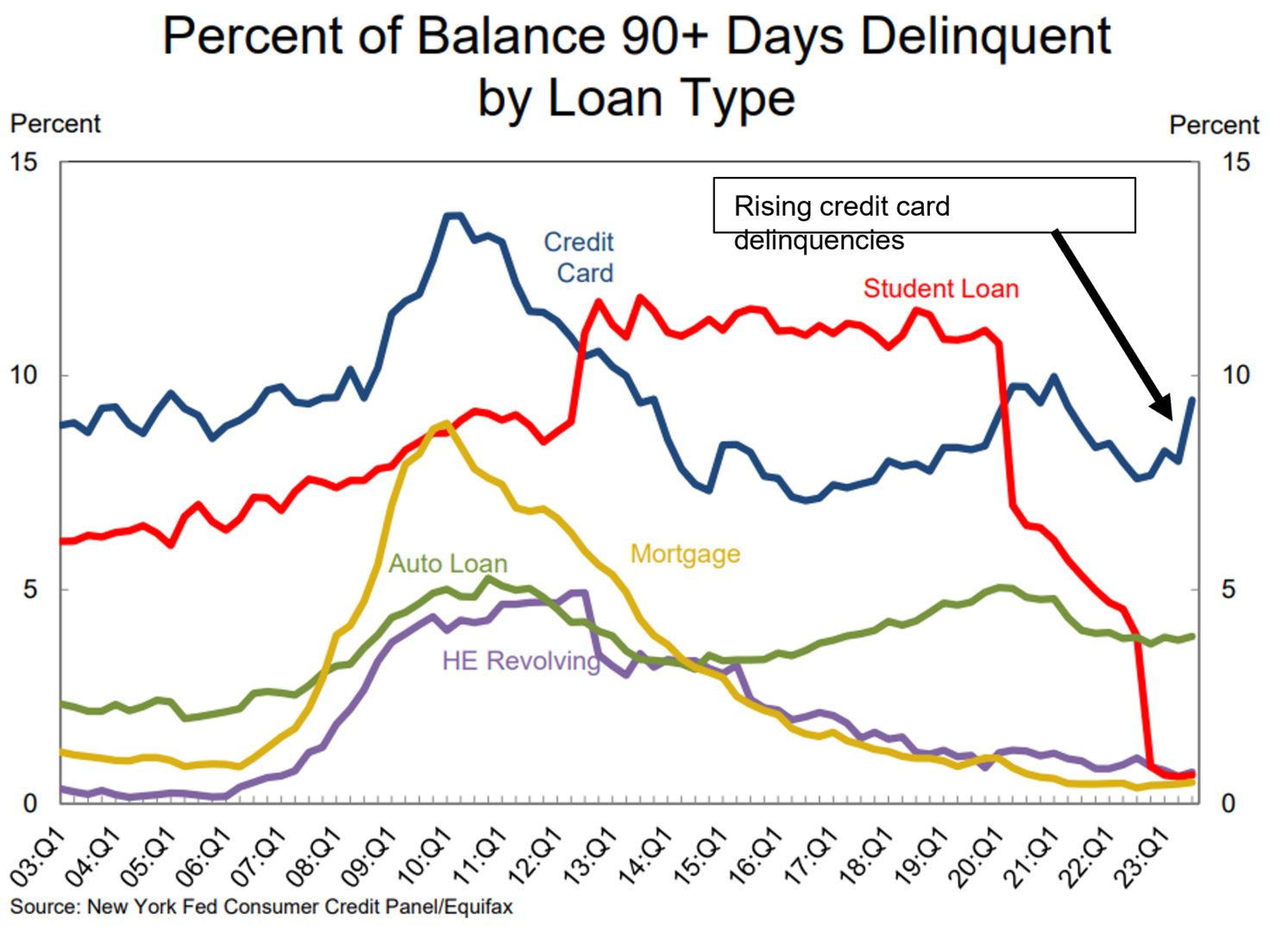

4. Credit Card Delinquencies on the Rise

- Credit card delinquencies of 90+ days have risen significantly in the latest quarter, currently at 9.4%.

- Other types of loans delinquent by 90+ days have essentially flatlined or declined in the last few quarters.

- The U.S. consumer has been resilient of late, helping domestic economic growth. However, the degree that credit was used to bolster spending remains to be seen as high interest rates are expected to continue.

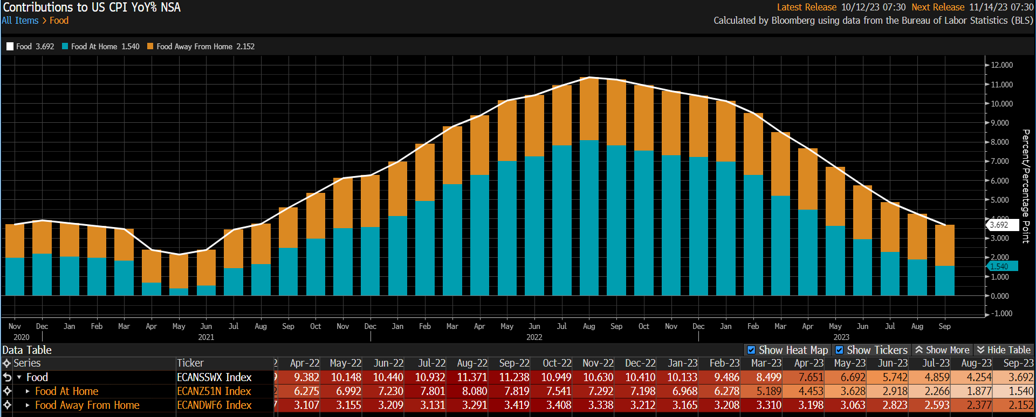

5. Grocery Inflation Rate Decreasing

- As displayed in the graph above, food inflation has decreased significantly from its recent peak in August 2022.

- Year-over-year comparisons show that groceries (food at home) increased 2.4% from September 2022 while dining (food away from home) increased 6.0% during the same period.

- Grocery inflation rates have decreased much more significantly than dining as supply chain issues were resolved to some degree after 2020, allowing consumers to prepare meals at home at a less expensive cost than dining out.

Sources: BTC Capital Management, Bloomberg Finance L.P., PSC Portfolio Strategy, LSEG Datastream, New York Fed Consumer Credit Panel, Equifax

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.