Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Treasury Yields Push Higher

- Federal Interest Rates Rise Rapidly

- U.S. Retail Gasoline Prices vs. WTI Oil Price

- Employee Layoffs and Discharges

- US Multi Asset Class Performance Comparison

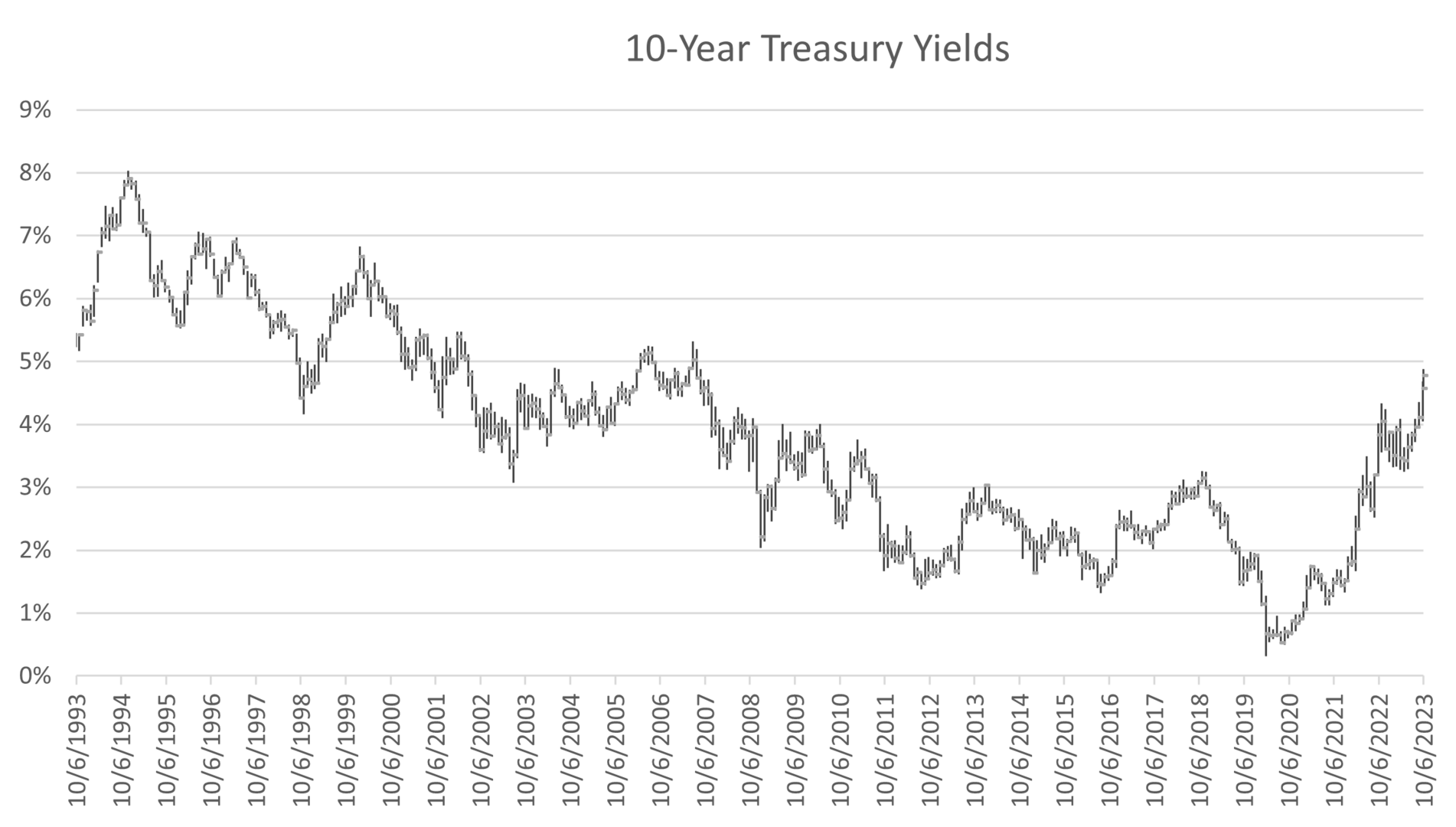

1. Treasury Yields Push Higher

- 10-year Treasury yields jumped to 4.88% after the employment report showed larger than expected job gains.

- The term premium is up another 50-basis points and near eight-year highs.

- Term premiums are up partly due to stocks and bonds becoming more positively correlated.

- Treasury yields dropped sharply in March, demonstrating diversification benefits during crisis.

- Recent yield moves have been focused further out of the curve as Fed terminal rate expectations have been stable.

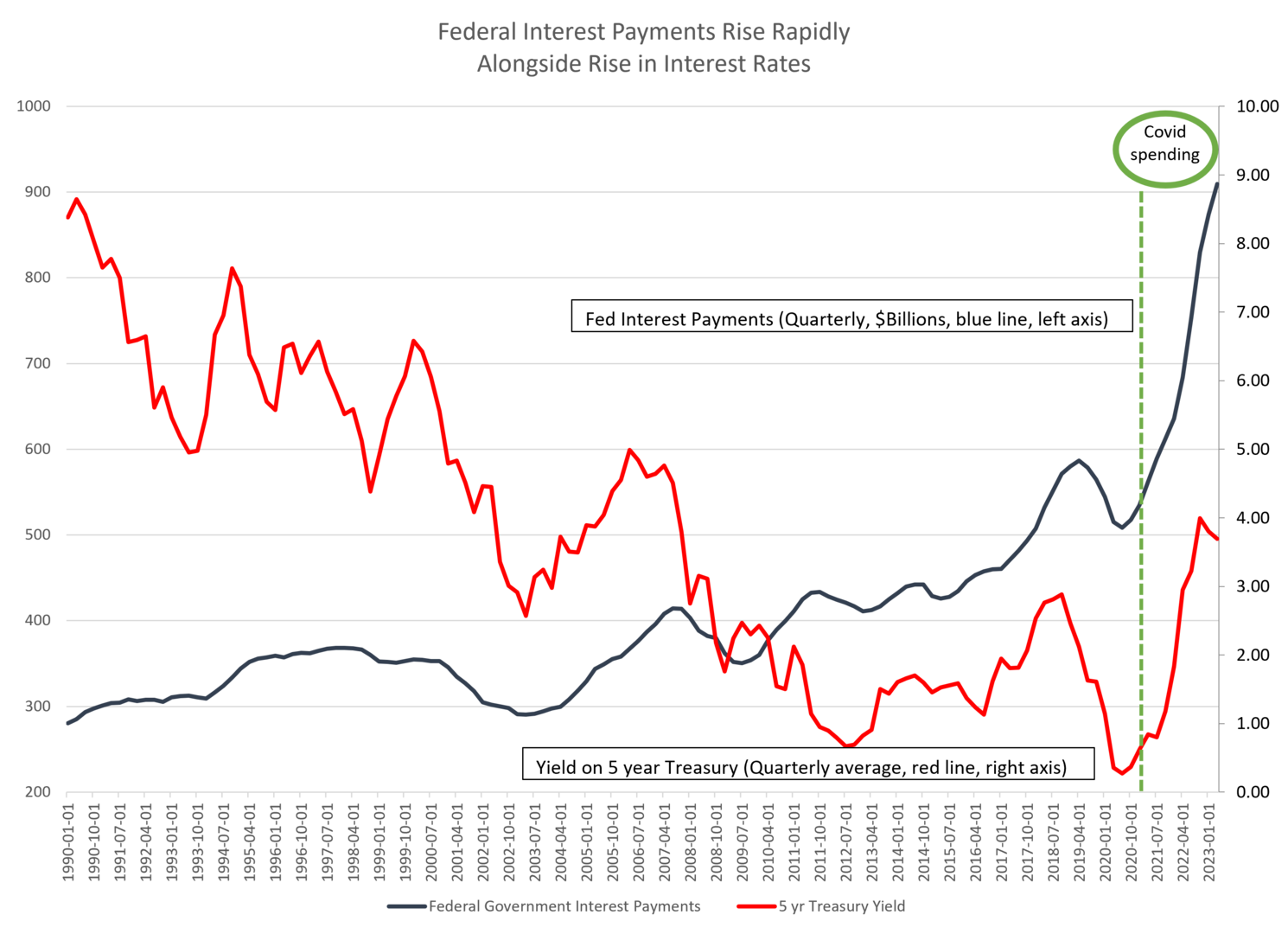

2. Federal Interest Rates Rise Rapidly

- Increased government spending since the 1990s has led to higher interest payments for the Federal government despite declining interest rates.

- The interest on debt payments has skyrocketed since Q1 2020 with the significant increase in government spending alongside the rise in rates.

- There are economic signals that interest rates may be “higher for longer,” resulting in continued elevated interest costs for the Federal government.

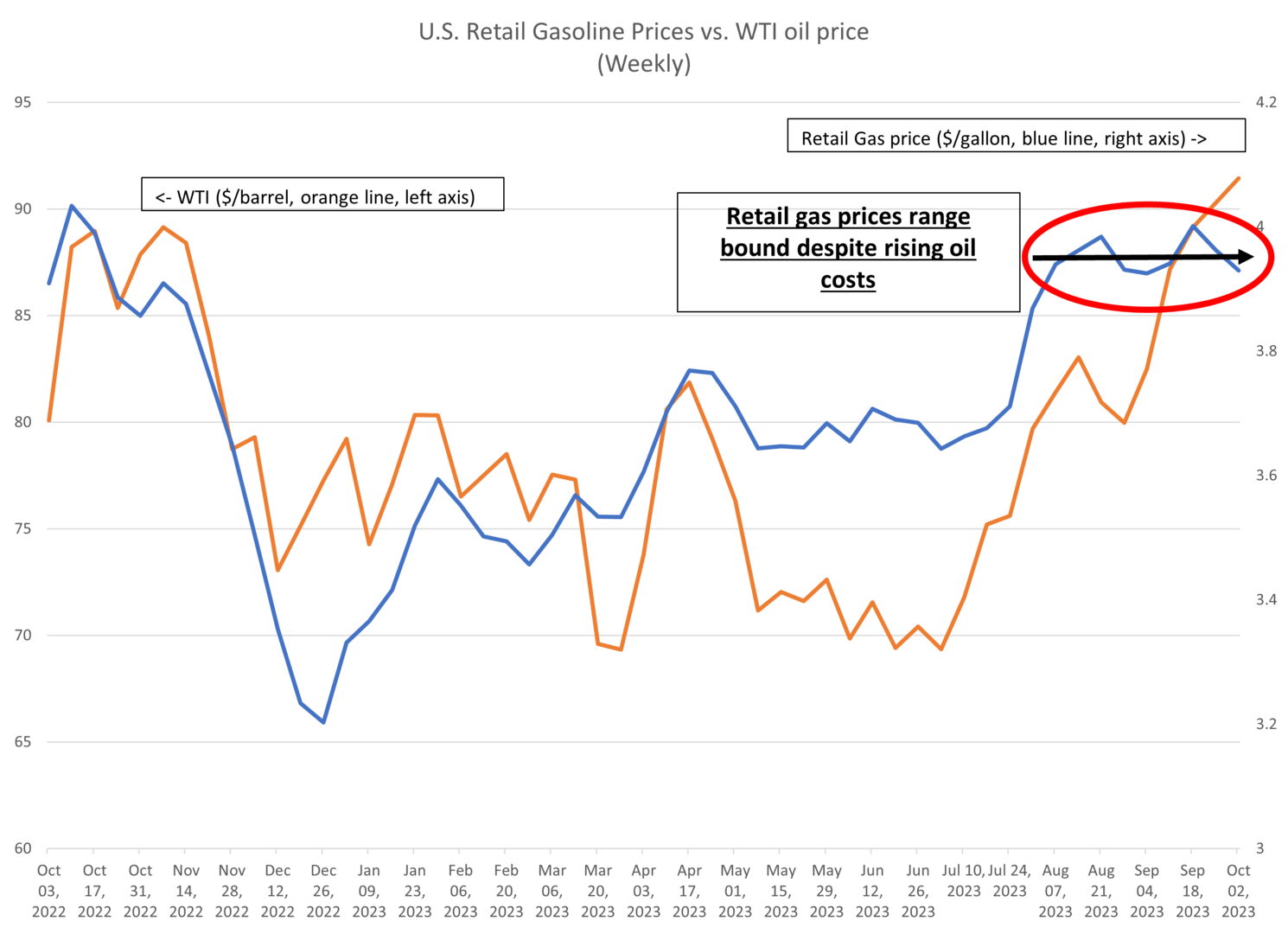

3. U.S. Retail Gasoline Prices vs. WTI Oil Price

- WTI oil prices have increased significantly since July 2023 due to various macro economic and fundamental factors.

- Retail gas prices did in fact rise in concert with the rise in oil prices but recently have leveled off despite the increasing cost of oil (WTI).

- The price of gas is driven by a host of factors including consumer demand, refinery capacity, and primarily, the underlying price of oil.

- With increased volatility in the global oil markets, it remains to be seen if the price of retail gas will remain rangebound.

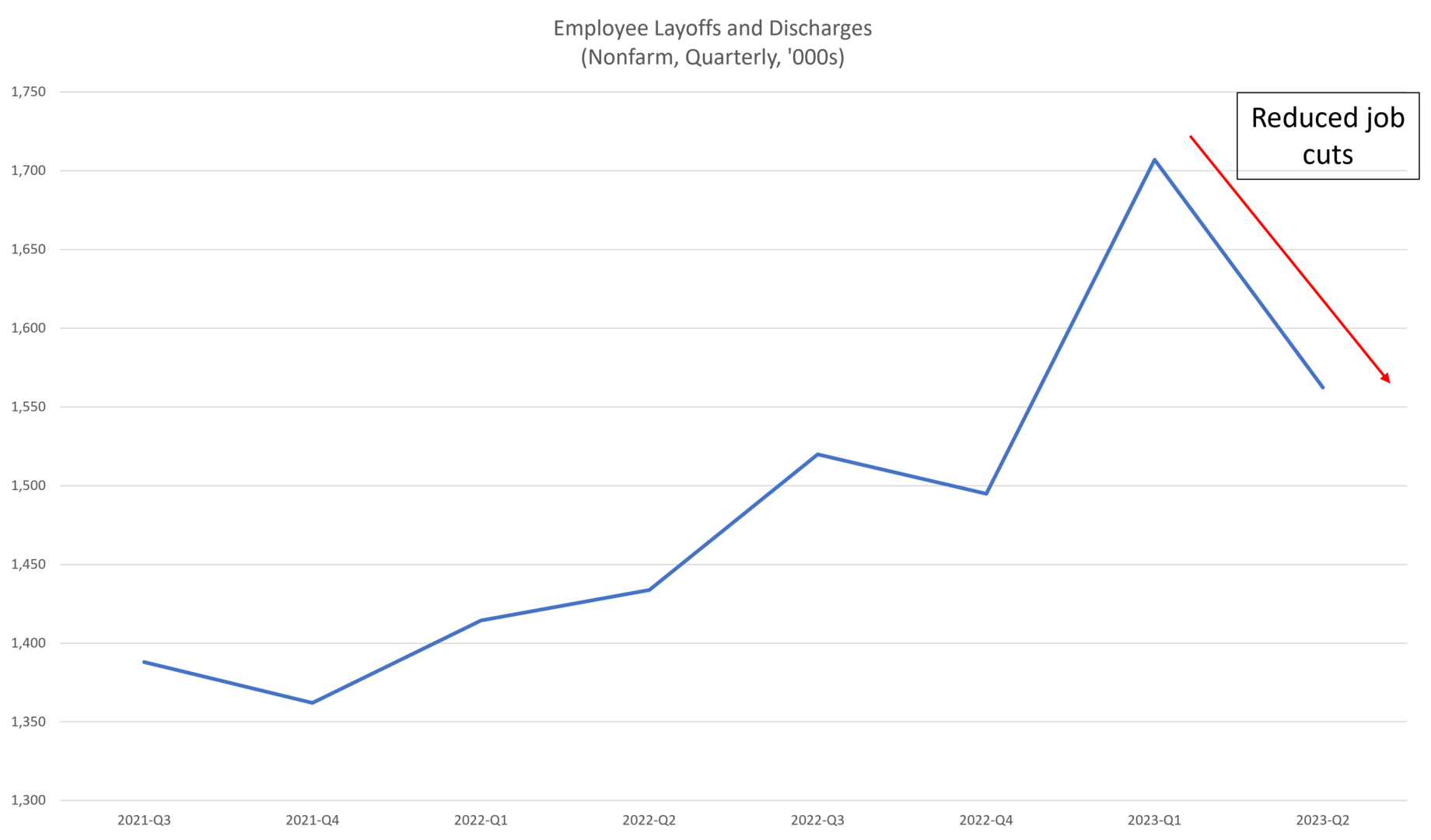

4. Employee Layoffs and Discharges

- Employee layoffs dominated the headlines in the first half of 2023, specifically in the technology sector.

- Factors such as cost cutting measures by corporations and the introduction of A.I. have led to increased layoffs.

- However, since earlier this year, layoffs have declined as companies look to “right size” their staffing requirements, which includes reducing the number of job cuts, and, for companies specifically in the service sector, look to increase staffing as resilient consumer demand continues to buoy the need for additional employees.

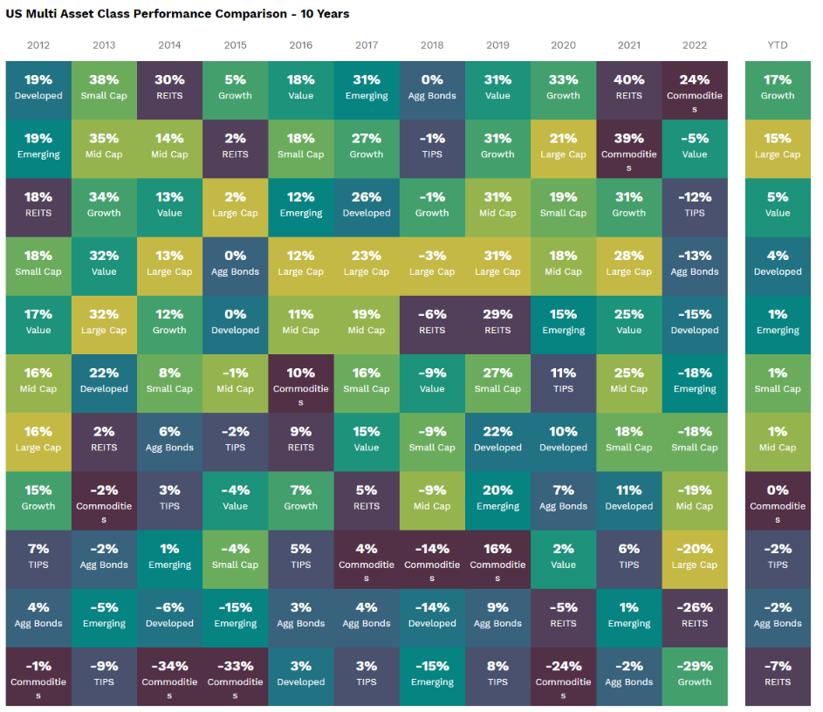

5. US Multi Asset Class Performance Comparison

- Investors have focused on sustainability of margins and liquidity which has favored U.S. large cap over other equity-related classes.

- Year-to-date through the third quarter, U.S. large cap equities continue to lead broad market indexes.

- Growth has maintained leadership throughout 2023, outpacing Value +17% to +5%.

- Domestic large cap has outperformed small cap +15% versus +1%.

- Developed markets have outperformed emerging markets +4% versus +1%.

Sources: BTC Capital Management, Bloomberg Finance L.P., St. Louis Federal Reserve, U.S. Energy Information Administration, FactSet Financial Data and Analytics

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.