A Sobering Start

Investors were treated to a double dose of negativity in the first quarter as both stocks and bonds declined over the three-month period. Strong inflation readings accompanied by an initial increase in the Fed Funds Rate and an expectation for additional increases led to the broad fixed income market generating a return of approximately -6.0%. U.S. equities fared somewhat better with a return of -5.3%, as measured by the Russell 3000 Index of U.S. companies, while equities outside the United States saw a return that was equal to domestic issues at -5.3%, as measured by the MSCI ACWI ex U.S. Index.

As we entered 2022, the U.S. economy had considerable momentum as evidenced by the 6.9% rate of GDP growth generated in the fourth quarter of 2021. This growth was fed by strong demand from consumers that enjoyed significant purchasing power due to policy measures taken to offset the economic impact of the coronavirus pandemic. Adding to this strength was a physical reopening of the economy.

The expectation for economic growth in the United States in 2022 is a moderation of the results experienced in 2021. This deceleration will, to a significant degree, be due to the termination of emergency stimulus programs implemented at the height of the pandemic and a resulting slowing of demand from consumers.

In addition to the factors expected to influence the economy and financial markets in the first quarter, there were two developments not widely anticipated. The first is the Russian invasion of Ukraine. The second is the COVID outbreak currently taking place in China. These two factors prospectively influence the economy in two ways. Given Ukraine’s prominent role regarding numerous commodities, a restriction in supply accentuates already strong inflationary pressures for numerous industries. And economic weakness in China due to reduced activity attributable to COVID lockdowns could ripple throughout the world including the potential for slowing progress on the easing of supply chain pressures.

Looking Forward

As outlined above, this year is off to a sobering start. With declining financial markets and weakening expectations for economic growth, it would be easy to extrapolate these developments into disappointing full year results. While such a scenario could indeed play out over the next nine months, it is not our current base expectation.

While the economy is expected to advance at a modest pace this year, we do expect it to move higher. Currently we anticipate an increase of 2.5 – 3.5% for the year. An acceleration in growth is projected to start this quarter as the economy bounces back from an anemic first quarter growth rate of 1.0 – 2.0% with a reading of 2.5 – 3.0% for the second quarter.

A prospective counter to our outlook for the economy is the prospect for recession due to the recent inversion of the U.S. Treasury yield curve. While a recession does frequently follow an inversion in the yield curve, it does not typically occur immediately. Looking at historical inversions involving 2-year and 10-year Treasury issues going back to 1965 reveals a median elapsed time between curve inversion and recession inception of 20 months. The shortest inversion to recession period was seven months in 2019. And we can all agree that the onset of the coronavirus pandemic was the most significant factor in creating the ensuing recession in that instance.

Supported by a backdrop of forecast expansion we also anticipate earnings and revenue growth in 2022 albeit at more modest rates than those achieved last year. Close attention will be paid to prospective revisions in the estimate for these two measures as we move further into 2022.

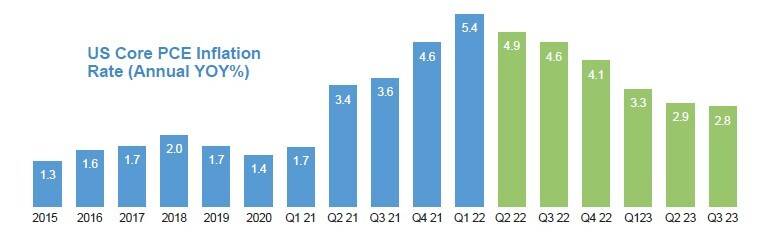

A moderating level of inflation has been part of our outlook for some time and as evidenced by recent readings, the expected deceleration has not yet arrived. We still anticipate core inflation will moderate in the second half of 2022. This expectation is based on a slowing economy due to subdued consumer spending on non-necessities, an increase in labor supply which will help slow future increases in wage growth, and the impact that higher interest rates are already having on industries like housing.

Asset Allocation Review & Outlook

Throughout the first quarter, we maintained our neutral positioning across our five investment objectives. Given the relative homogeneity of returns across asset classes, there was not a significant amount of performance discrepancy across our spectrum of asset allocations.

Our most recent significant change in asset allocation positioning occurred last year when we lowered our equity exposure by reducing the weight assigned to large cap domestic equities. The exposures to domestic small cap and foreign equities were already being maintained at neutral levels.

Going forward, we will continue to evaluate prospective changes to our allocations both across and within asset classes. These evaluations will be conducted within the framework of our investment process which is governed by the four tenets of our investment philosophy. The tenets include a focus on risk aware portfolio construction, investment decisions based primarily on strong fundamentals, a long-term view of the markets, and capital preservation in difficult markets. Coincidental to this process will be acknowledgment that not all events that impact financial markets and economies can be anticipated but must be incorporated as factors in outlooks for the economy and financial markets. The aforementioned COVID outbreak in China and invasion of Ukraine by Russia are two such examples. As former President Dwight Eisenhower is quoted as saying, “In preparing for battle, I have always found that plans are useless, but planning is indispensable.” The same can be said for economic forecasts and investment outlooks. It’s the process and its adaptability that matter most.

In closing, investment environments and returns like those experienced in the first three months of 2022 provide impetus for investors to review their goals and objectives and to evaluate if their current asset allocations are still the most appropriate for them as we move throughout the remainder of the year.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.