We received some significant news from the Federal Reserve (Fed) this week. The Fed indicated they could keep rates where they are until 2022. “We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates,” said Federal Reserve Chair, Jerome Powell.

Initial unemployment claims for the week ended May 30 were better than the previous month’s claim number. The reading of 1.877 million claims, despite being higher than the expected 1.8 million, shows the pressures on unemployment offices nationwide may be abating. The previous week’s number was 2.126 million. The positive trend in employment led to a decrease in the unemployment rate in May to 13.3% from the previous month’s 14.7%. The expectation was for a rate of 19.6%. Why the large variance? According to the U.S. Department of Labor, the rate was impacted by a calculation error. A portion of the error centered on how companies are accounting for workers who are on the books but absent without pay. The recommendation is these workers be classified as unemployed. This was not always the case with the employment data presented. This error has the potential to increase the unemployment rate by up to 3%.

The year-over-year increase in earnings continued. In May, earnings grew by 6.7%. As discussed in a previous Weekly Insight, the earnings growth number is artificially inflated due to the lockdowns more significantly impacting low wage jobs.

The Consumer Price Index (CPI) remains flat year-over-year. May’s price change rate of 0.10% was lower than the expected 0.20%. Energy prices are the major influences for the low number. The number is up to 1.2% after excluding energy and food. Month-over-month, there was a decrease in CPI price levels. Both core and headline CPI decreased by 0.10%.

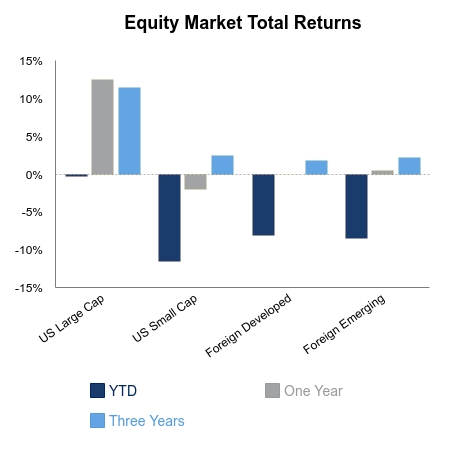

We saw positive equity market moves this week. The S&P 500 was up 2.19%. This increase was led by strength in the Information Technology sector, up 4.52%, and the Consumer Discretionary sector, up 2.67%. We continue to see strength in the Energy sector. After the first quarter, the Energy sector was down 50%. The current year-to-date return for the Energy sector is -27.68%, which is a meaningful appreciation. Month-to-date, the sector is up 10.39%. An expected increase in demand for oil as lockdowns continue to lift is spurring the growth.

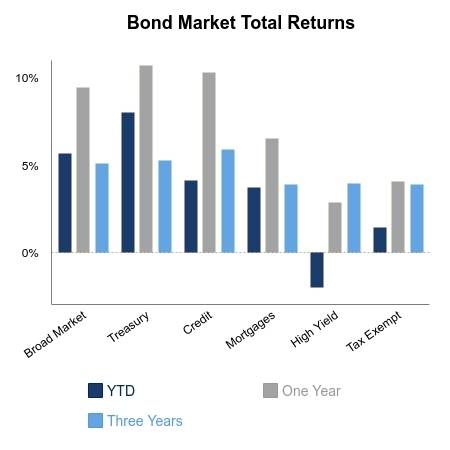

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.