Tidings of Continued Inflation

All eyes this week were focused on inflation, which appears to remain sticky. The U.S. Bureau of Labor Statistics (BLS) reported two key measures of inflation beginning with the Producer Price Index (PPI) for finished goods. PPI for September was higher than expected, rising 0.4% versus expectations of 0.1% and the prior month’s decline of 0.2%. Year‑over‑year PPI has increased 8.5%, modestly below August’s increase of 8.7%.

BLS followed up with its Consumer Price Index (CPI) for September. Like PPI, CPI rose more than expected; 0.4% versus 0.2%. CPI ex-food and energy rose 0.6% versus expectations of 0.4%. Inflation within regions outside the U.S. has continued to rise at a rate higher than that of the U.S. Within regions like the UK, Sweden and Germany, inflation is near or exceeds 10% year‑over‑year.

The Conundrum of Monetary and Fiscal Policy

Other than inflation, the UK captured recent headlines given its monetary and fiscal conundrum. Wanting to battle inflation (9.9% year‑over‑year through August) without inducing a recession, both monetary and fiscal authorities introduced plans that call into question the credibility of both bodies. The Bank of England has raised rates to combat inflation yet found itself having to prop-up UK government bonds through recent purchases. Fiscal authorities have introduced stimulus plans, including tax cuts and energy relief, to fend off a recession. This will be an interesting case study given global inflation, the efforts of monetary and fiscal authorities to battle inflation while desiring an economic “soft‑landing”.

Market Reaction

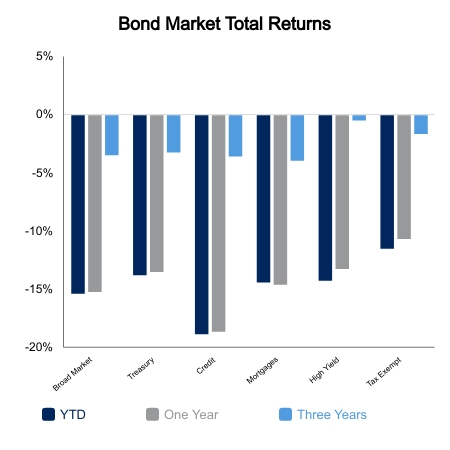

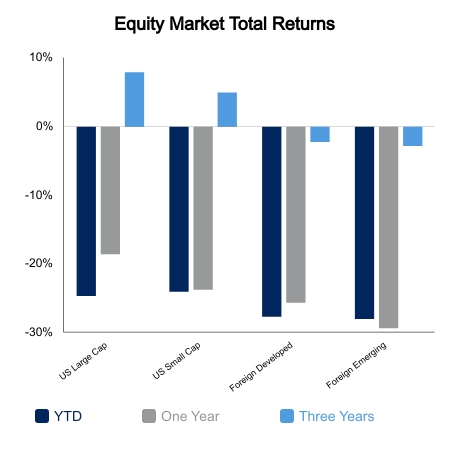

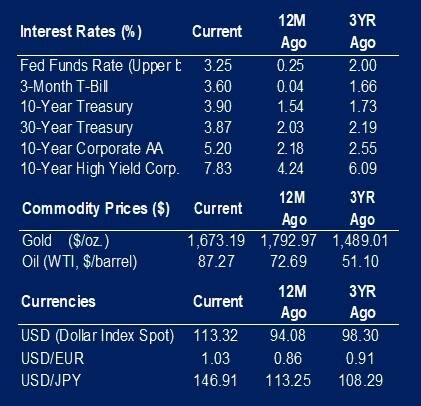

Since our last Weekly Insight, the yield on the 10-Year U.S. Treasury rose by 14 basis points to 3.9%, resulting in a negative return of 0.7% within a broad, market-weighted bond index. Over that period domestic equities declined 4.5% and foreign equities fell 4.1%.

What’s in Store

This week kicks off third quarter earnings season. Earnings remain front-of-mind to equity investors. Check out our recent Five in Five, in which we discuss analyst estimates for earnings growth on a quarterly basis.

Analysts currently estimate earnings per share (EPS) for 3Q2022 will grow year‑over‑year by 4.5%. This is less than half the growth rate projected as of the beginning of the third quarter when analysts estimated year-over-year growth in EPS of 11.1%. Another critical aspect of this earnings season will be the guidance provided by corporations going forward.

On the economic front, Retail Sales for September is on the docket, as is the Index of Consumer Sentiment survey by the University of Michigan for October. Next week also presents several other key economic indicators so stay tuned.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.